Managing personal finances can be overwhelming, but it doesn’t have to be. With the right mindset and strategies, you can take control of your financial future.

The CityGirlBudget Breakdown offers practical advice for managing your money, reducing debt, and setting long-term financial goals.

Let’s get started!

Understanding Your Financial Foundation

Before diving into the intricacies of budgeting and debt management, it’s essential to understand your financial foundation. This includes knowing your income, expenses, and financial goals.

Analyzing your situation allows you to create a plan that works for you.

Create a Simple Budget

The first step to financial freedom is creating a budget. Track your income and expenses to identify areas where you can cut back.

Using an app or a simple spreadsheet can make budgeting more manageable. Be sure to include all essential expenses, such as rent, utilities, groceries, and transportation.

Furthermore, supporting family members, especially abroad, is a common financial responsibility. Treat these payments like any other bill. Set a specific amount for family support in your budget.

This way, you stay on top of your finances. Review your budget regularly to ensure you’re not overspending. Balancing family help and your own financial goals is key.

Tip: Aim for the 50/30/20 rule. Allocate 50% of your income to essentials, 30% to discretionary spending, and 20% to savings or debt repayment.

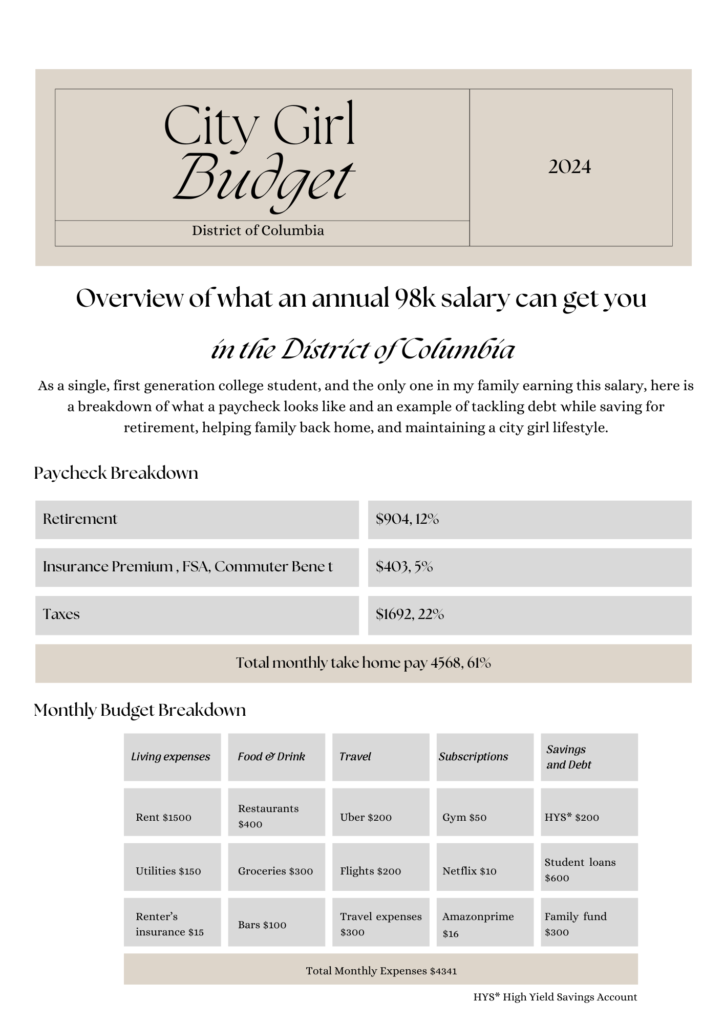

Here’s an example of an ideal budget for a city girl with an annual 98k salary in the district of Columbia:

Reduce Unnecessary Spending

Once you have your budget, it’s time to identify areas where you can cut unnecessary costs.

Small changes, like cooking at home instead of dining out, canceling unused subscriptions, or finding cheaper alternatives for entertainment, can lead to significant savings over time.

Tip: Track your spending for at least a month to uncover hidden expenses that add up. Apps are a great way to track your personal financing progress.

Tackle Debt: The Key to Financial Freedom

For many, student loans, credit card debt, and personal loans are heavy burdens. The key to managing debt is creating a repayment strategy.

Consistency is key whether you prefer the debt snowball or debt avalanche method.

Debt Snowball vs. Debt Avalanche

- Debt Snowball: Pay off your smallest debt first. Once it’s paid off, move to the next smallest debt. This method provides quick wins and motivates you to continue.

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first. This method saves you money in the long run.

Tip: Whichever method you choose, stick to a consistent repayment schedule. Consistency is crucial for financial success.

Save for the Future

When it comes to personal financing, saving money is just as important as budgeting and debt management.

Emergency Fund

An emergency fund is your safety net for unexpected expenses. Financial experts recommend saving three to six months’ worth of living expenses in a liquid savings account.

This fund will help you cover emergencies without going into debt.

Retirement Planning

It’s never too early to start saving for retirement. Contributing to an employer-sponsored 401(k) or opening an IRA can help you build wealth over time. The earlier you start, the more time your money has to grow.

Tip: If your employer offers a 401(k) match, try to contribute enough to take full advantage of the match.

Looking for more personal finance tips and tricks? Visit our website for all the financial literacy content!

FAQ: Personal Financing and City Girl Budget

1. How do I create a simple budget?

To create a simple budget, track all your income and expenses. Use a tool or app to categorize your spending.

Follow the 50/30/20 rule, allocating funds for essentials, discretionary spending, and savings/debt repayment.

2. What is the best way to pay off debt?

The best way to pay off debt depends on your situation. The debt snowball method helps you focus on smaller debts first, while the debt avalanche method saves you money by targeting high-interest debts. Choose the strategy that fits your lifestyle and goals.